Debt consolidation

Debt consolidation

Debt consolidation

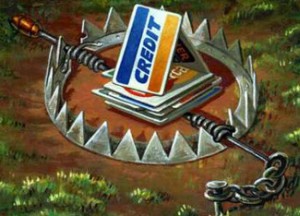

Debt consolidation means consolidating your several loans into one. Debt consolidation means taking one big loan to pay off several small ones. You can opt for this kind of loan if you are looking for convenience. There will be no hassles to write several checks and deliver them. Just write one check and your worries will be over till the next month. Also you will discover that your loan interest charges will decrease by taking debt consolidation help. So you will be in a position to save some money every month.

A more successful way is to opt for debt consolidation help in order to manage several debts which have high interest rate. In most of the cases if you settle with debt consolidation help then you need to keep something as security most probably your property. So think twice before opting for debt consolidation loan as it might put you in high risk and you might even lose out on your home.

Consolidating debt makes your loan more manageable. It helps so in making a proper budget and more importantly to follow it giving you the power to control your finances and thus reducing stress. It makes the whole process of loan paying very convenient. It reduces the high interest rates on your loan. It also gives you the flexibility to extend the duration of your loan. But one thing to be kept n mind is by increasing the duration of your loan you are also increasing the total interest cost. Your credit score suffers when there is default from your side while paying certain installments of your loan. Due to Bad credit score you might be further denied a loan. Bad credit score also affects your reputation. So by choosing for debt consolidation help your credit score would not hurt. Moreover there will be no chances of late charges as instead of paying for several loans you would just be paying for one loan.

But before signing on the dotted line, make a promise to yourself that you would be self-disciplined in paying out this high risk loan otherwise you and your family might have to face serious financial consequences. Chances are any neglect side in paying from your loan might lead you to file for bankruptcy.